Hotstuff: Confidential Integrated Finance

The Capital Efficiency Gap: Why DeFi’s Composability Doesn’t Compound

DeFi’s composability is genuinely beautiful. The money lego thesis works.

Stake ETH in Lido → deposit wstETH in Aave → borrow ETH → stake again. Recursive loops that couldn’t exist in traditional finance. Protocols building on protocols. Atomic transactions spanning multiple venues in a single block.

This isn’t the problem. This is the miracle.

The problem is that composability doesn’t compound.

Moving between Aave, Lido, and Uniswap works. Each hop costs gas. Each protocol takes a cut. None of them benefits from the others’ success. The legos snap together, but they don’t accelerate each other.

Your Aave deposit doesn’t make your Uniswap trade better. Your Uniswap LP doesn’t improve your Aave borrow rate. The pieces connect, but they don’t reinforce.

What Integration Actually Looks Like

When products are integrated at the protocol level, they compound:

Your vault deposit becomes margin for trading

Your trading generates fees for the vault

Your collateral earns yield while backing your positions

Liquidations flow through orderbooks, creating organic volume

Volume attracts more liquidity, tightening spreads

Tighter spreads attract more traders

Each product makes the others better. The flywheel spins.

This is what DeFi could be but isn’t.

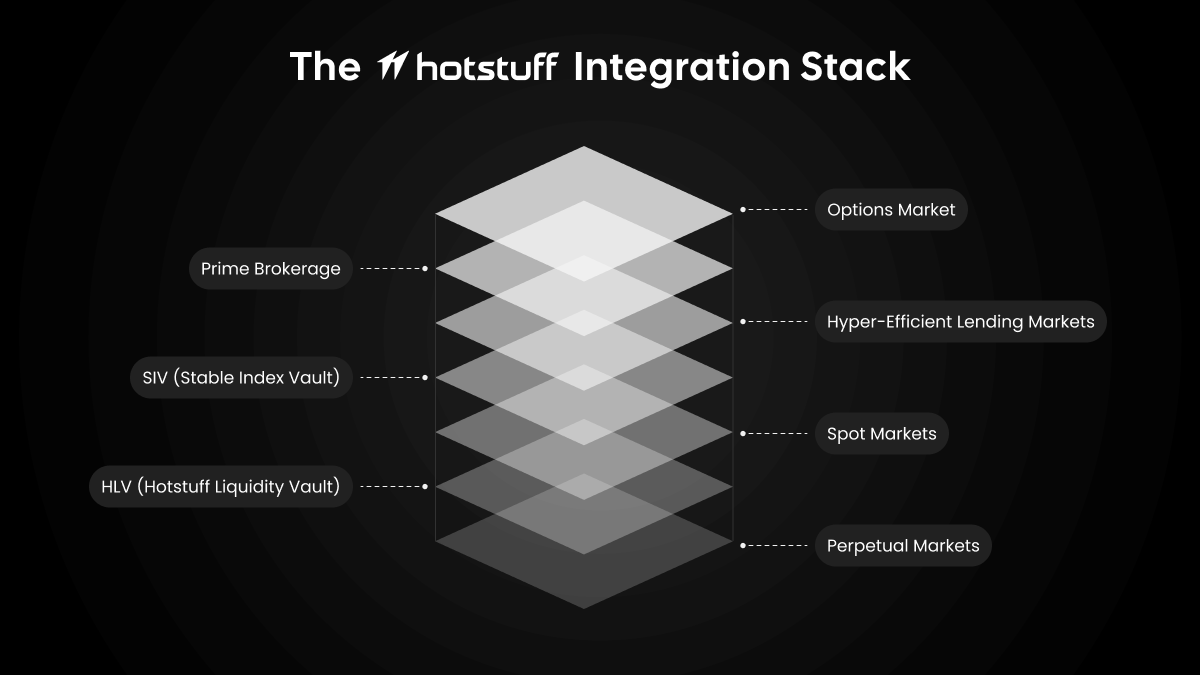

The Hotstuff Integration Stack

Hotstuff is the first DeFi venue where everything is integrated by default and where, eventually, everything is confidential.

Perpetual Markets

50x leverage on major pairs

Hedge mode support for sophisticated strategies

Portfolio margin across positions

Integrated with vaults and lending: liquidation flow feeds the system

Spot Markets

Fully onchain orderbook

Native integration with perps for delta hedging

Non-USD stablecoin pairs (EURC, JPYC, and more)

Crypto Options

Options are non-negotiable for a mature crypto ecosystem. Without them, sophisticated hedging is impossible, and the market lacks a critical tool for price discovery and risk management.

Daily, weekly, monthly, and quarterly expiries

Portfolio/SPAN margining across options and perps

Integrated with spot and perps for seamless delta hedging

The reason options have struggled in DeFi isn’t product–market fit. Deribit proves institutional demand exists, and Derive and Rysk have shown that retail demand is growing. The problem is infrastructure.

Options require portfolio margining for capital efficiency, high performance to support a large instrument set, and tight integration with perps for effective hedging. Most DeFi options projects failed because they built options in isolation. We’re building options as part of our integrated stack.

HLV (Hotstuff Liquidity Vault)

Deposit and become a market maker across all books

Multi-venue capable: HLV can route through Hyperliquid, CeFi venues, and anywhere where liquidity is deep

Your vault shares are valid collateral

Democratized market making, you earn what professional market makers earn

What makes HLV different from Hyperliquid‘s HLP or Lighter‘s LLP?

HLP & LLP market-makes on Hyperliquid’s books only. HLV can trustlessly route through multiple venues, Hotstuff’s native orderbooks, Hyperliquid’s books when liquidity is better there, and CeFi venues via off-exchange custody solutions. The vault sources liquidity wherever it’s deepest. This was technically not possible in 2024-2025 when HLP/LLP were launched. Hyperliquid itself provides a multisig order placement, making it the first trustless venue which HLV will utilize. Further, even CeXs like Binance and Deribit have enabled support for ed25519 api keys, which HLV uses currently for trustless order execution on these venues via consensus ops. These primitives are built directly into hotstuff with no trusted intermediaries.

SIV (Stable Index Vault)

Your stablecoins are probably dead capital right now. Sitting in a wallet earning 0%, or parked in some LP you can’t really use.

We’re in a new era of stables: USDC, USDT, PYUSD, RLUSD, Klarna’s USD, and chain-native dollars everywhere. Every week, some fintech or chain spins up another digital dollar, and most of that balance just sits.

SIV flips that:

Your stablecoins run delta-neutral market making across stable pairs

Holds a basket of blue-chip stables (USDC, USDT, PYUSD, RLUSD, and more)

Earns spread + maker rebates + rebalancing fees

Simultaneously serves as perp collateral

Yield and utility, not just yield or utility

No leverage and directional bets, pure stable spot books. Just tight, symmetric spot quotes earning from real market structure returns while your balance stays productive as collateral for trading.

Hyper-Efficient Lending Markets

Lending in DeFi is typically isolated. When someone gets liquidated on Aave, that flow doesn’t route back to them. External liquidators extract value. The lending protocol doesn’t benefit from having a trading venue.

On Hotstuff:

Liquidated positions route through spot and perp books

If spot liquidity is insufficient, delta is immediately hedged via perps

Result: higher LTVs for borrowers, organic flow for the venue

Support for DeFi-native collateral: aUSDT, aETH, wstETH

Your yield-bearing assets don’t have to stop earning to be used as collateral.

DeFi Prime Brokerage

Institutional traders have had prime brokerage services forever, portfolio margin, multi-collateral support, unified reporting, and sophisticated risk management. DeFi hasn’t offered anything comparable.

Until now.

Native portfolio margin across perps, spot, and options

Multi-collateral support via lending markets

Underwater collateral is auto-borrowed, not force-liquidated

Institutional-grade capital efficiency, permissionless

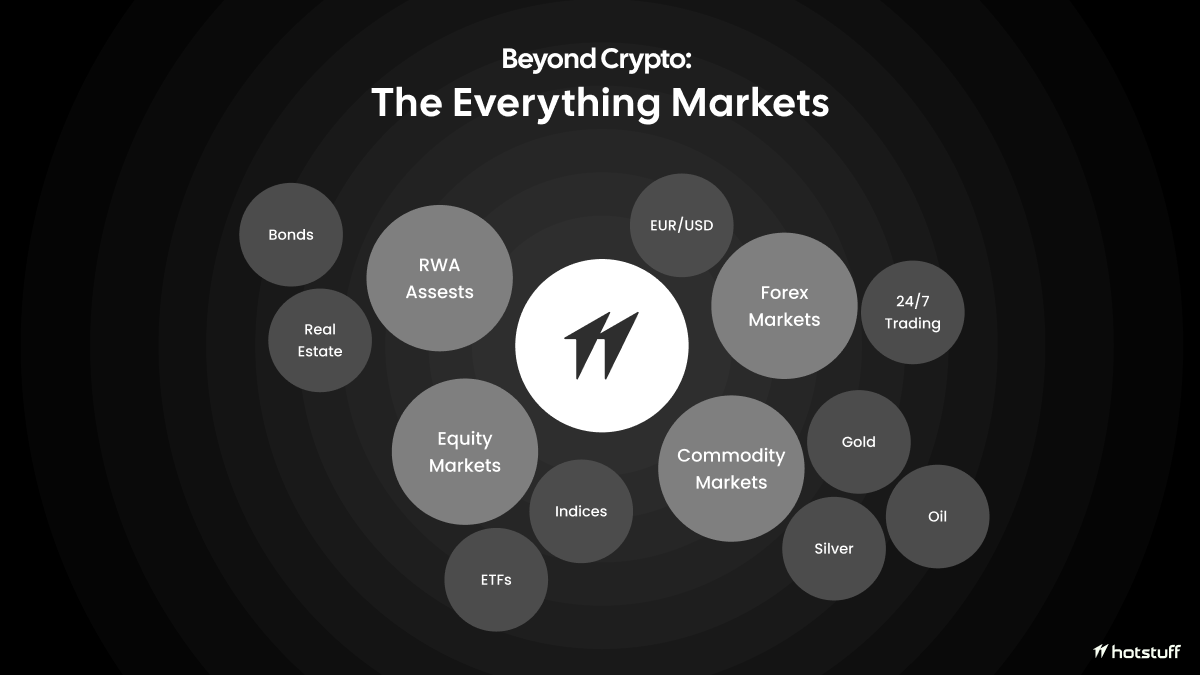

Beyond Crypto: The Everything Markets

The venue that wins isn’t the best exchange. It’s where capital lives.

Users don’t just need a place to trade. They need somewhere to custody capital safely, earn yield when idle, unlock margin when needed, trade when opportunity strikes, and spend when life demands. Trading is one function. The real product is a home for capital, a place where users leave their money even when they’re not actively trading. A place they can call home.

Composability Without Flash Loans

The counter-argument to vertical integration is clear: doesn’t this close off DeFi’s composability? If everything lives on Hotstuff, how does it compose with the rest of DeFi?

The answer is: composability takes many forms. Atomic same-block composability is one form. It’s not the only form and arguably not even the most important one.

Composability Already Looks Different

Hyperliquid’s builder codes make perp markets composable without same-chain atomicity. Protocols integrate via signed messages and off-chain coordination.

Pyth operates a chain that publishes pull-based timestamped oracle updates. But it can publish anything position proofs, order confirmations, and account states.

Lighter has a gateway that allows users to place orders via Ethereum. Cross-chain order execution, no bridging required.

Hyperliquid’s corewriter enables composability between HyperEVM and HyperCore with next-block guarantees. Not atomic, but predictable.

Traditional finance was built entirely on async API calls. Banks don’t have flash loans. They have settlement windows, confirmation messages, and state proofs. It just works.

Hotstuff Gateway Contracts

Hotstuff introduces gateway contracts that enable composability with external chains:

Read operations: Pull-based updates from Hotstuff. Position proofs, order confirmations, account states, and anything protocols need to verify the Hotstuff state on their chain.

Write operations: Execute operations on Hotstuff with a Solidity function call. Place orders, cancel orders, create agents, transfer assets. From Ethereum, Arbitrum, any EVM.

The guarantees differ from atomic composability. Execution and finality have latency. But protocols can design around this, just like they design around oracle update frequency.

zkTLS proofs are cheaply verifiable on-chain. State proofs are compact. The infrastructure for async composability exists.

No flash loans. But flash loans aren’t why DeFi won.

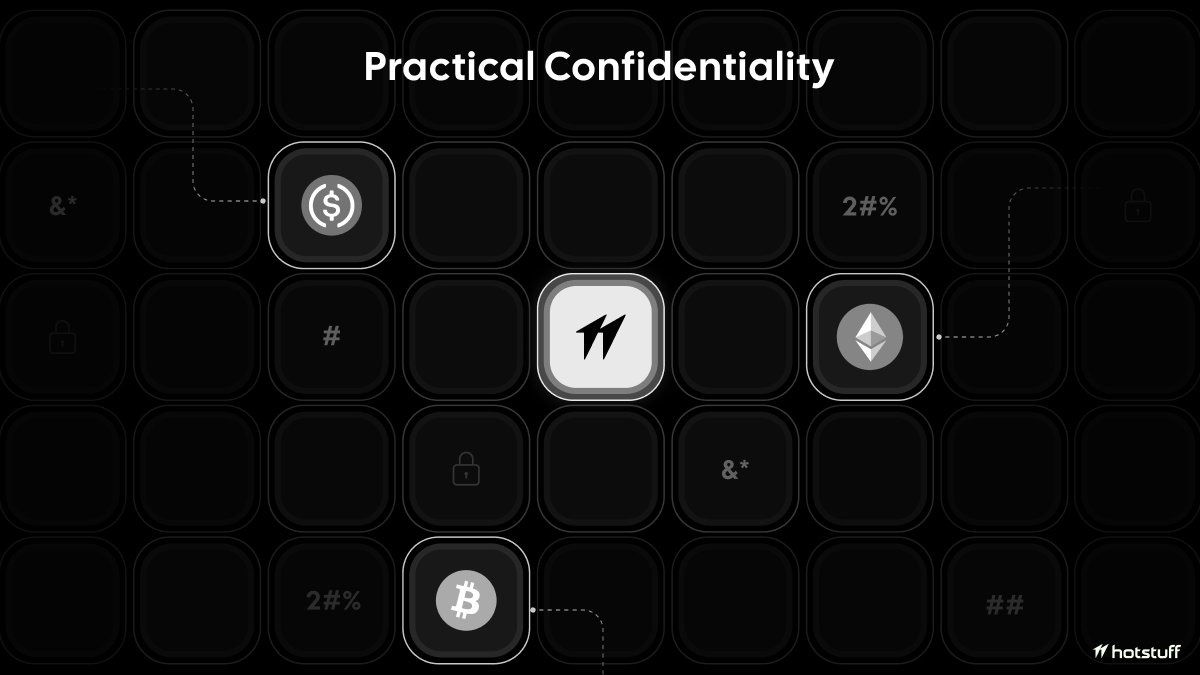

Privacy: The Thread That Connects Everything

Every trade on a public blockchain leaks information:

Your position size

Your entry price

Your liquidation level

Your strategy

Sophisticated actors can watch, MEV bots front-run your trades, and competitors can see your flow. Institutions can’t operate when everyone sees their book.

Privacy isn’t a feature. For serious finance, it’s a requirement.

Why It Creates Lock-In

Privacy creates something no other chain does: network effects through secrets.

“Bridging tokens is easy. Bridging secrets is hard.” -

When finance is public, switching chains is trivial; you can bridge and move on. When finance is private, switching is risky. Every hop leaks metadata: transaction timing, amounts, and patterns are exposed at the boundaries.

Users who choose privacy don’t casually leave. By combining privacy with efficiency, Hotstuff enables TradFi-level network effects.

Our Approach: Practical Confidentiality

Crypto’s approach to privacy has been non-practical. Privacy for privacy’s sake. Multi-minute proof generation. Isolated pools. Wallet gymnastics. Expensive fees. And whatnot.

This filters out users who want privacy but settle for CeFi, because convenience always wins.

Hotstuff builds confidentiality, not anonymity.

Confidentiality means:

Your positions are hidden from competitors and MEV bots

Your strategies aren’t broadcast

Your trading edge is protected

But you’re not hiding from everyone forever

What it requires:

Fast: No multi-minute proof waits. Trading happens in milliseconds.

Cheap: No ZK proof fees that make privacy a luxury.

Unified: No isolated pools. Private and public orders trade the same book.

Simple: Opt-in with a click.

Optional: Users choose their level.

How Hotstuff implements Confidentiality

Execution layer: All Validators run in Intel TDX powered TEE, which processes transactions in secure enclaves. All validator and position state is encrypted.

Consensus layer: Separation of public and private events, public events for consensus verification, and private events for user activity. Both are cryptographically linked and selectively revealed.

Phased rollout:

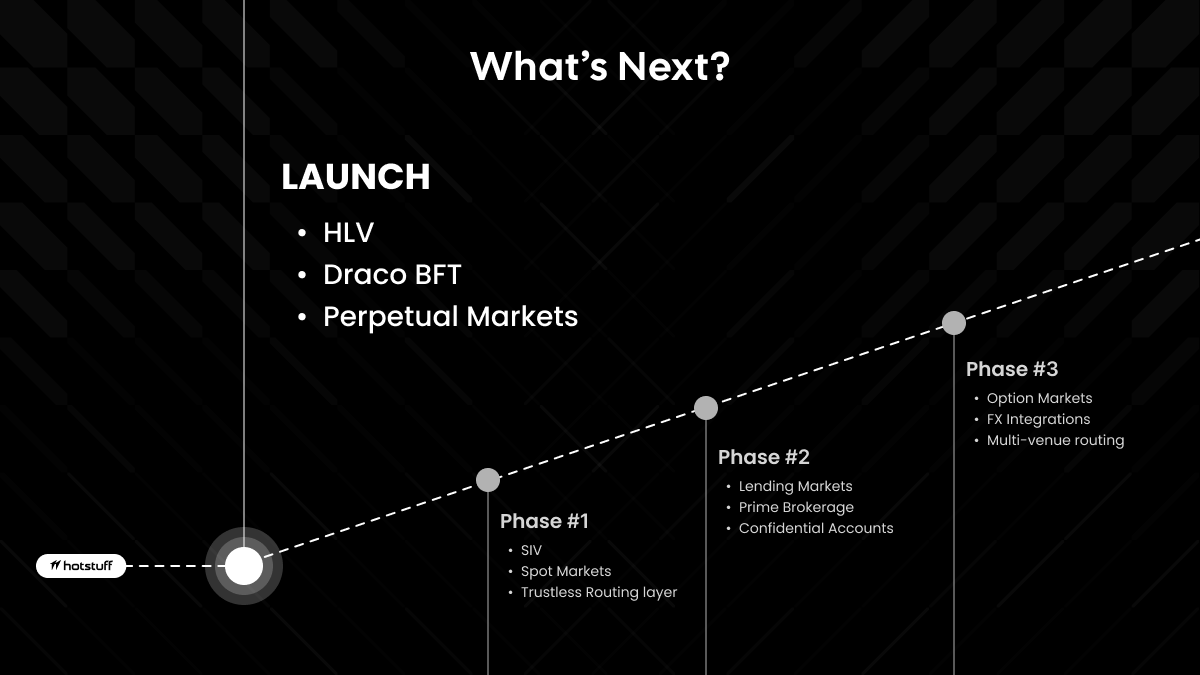

Phase 1-2 (Now): Public execution with the integrated stack

Phase 3: Confidential accounts

We’re not building for people who need to hide forever. We’re building for traders who don’t want to be front-run, institutions who can’t broadcast their book, and users who believe their financial activity is their business. Our approach doesn’t eliminate all leakage instantly, but rather minimizes and delays leakage where it matters most to our users.

The Totality: Confidential Integrated Finance

Our vision isn’t to be your preferred perp dex.

It’s about providing an ecosystem of financial products where you can safely custody capital, trade and invest in anything you want, access yield opportunities, onboard and offboard to fiat, and send, receive, and spend your money, all with full confidentiality.

Here’s what that looks like at large:

Custody: Your capital, your keys, encrypted at rest

Trade: Perps, spot, options, crypto, equities, forex, commodities - all with portfolio margin

Earn: HLV for market making, SIV for making stables productive, and lending for yield on collateral

Route: Fiat on/offramps, payments, FX, and validators route trustless flow (Part 1)

Spend: Send, receive, and move money without broadcasting your financial life

All integrated. All composable. All confidential.

The Bet

Hotstuff bets on these:

Integration beats fragmentation. The venue where everything works together wins.

Privacy becomes mandatory. The confidential exchange wins against the public one.

Validators become infrastructure. Chains where validators provide services create more value than consensus-only chains.

We’ve built all three, and we ship relentlessly.